Away from the rarified atmosphere of the Global Corporate with its leather seats, support departments, hierarchies and standards is the world that most of us business owners occupy – the ‘Real World’

In the ‘Real World’ your personal livelihood and that of your employees is at stake, and you as the business owner are responsible. Pretty heavy really, so no wonder owning and running a business can be such a lonely place.

We experience successes and failures along the way and many of these will be of our own making. So when you, like over 150 UK business owners every day, are hit with a Crisis that is completely out of your control such as a Fire at your premises, ill health or the failure of a critical supplier – what can you do to maintain your cash flow and protect your reputation?

In a Global Corporate you have a Business Continuity team who Assess Risk, Model Business Impacts, Write Plans and Conduct Tests and Audits. In the ‘Real World’ we know we should carry out more of this activity but we have today to worry about and that tends to get the attention.

In the run up to launching the Continuity Partner service we spoke to dozens of Small and Medium size business owners about their approach to Business Continuity in the ‘Real World’ and three fascinating responses came up time and again:

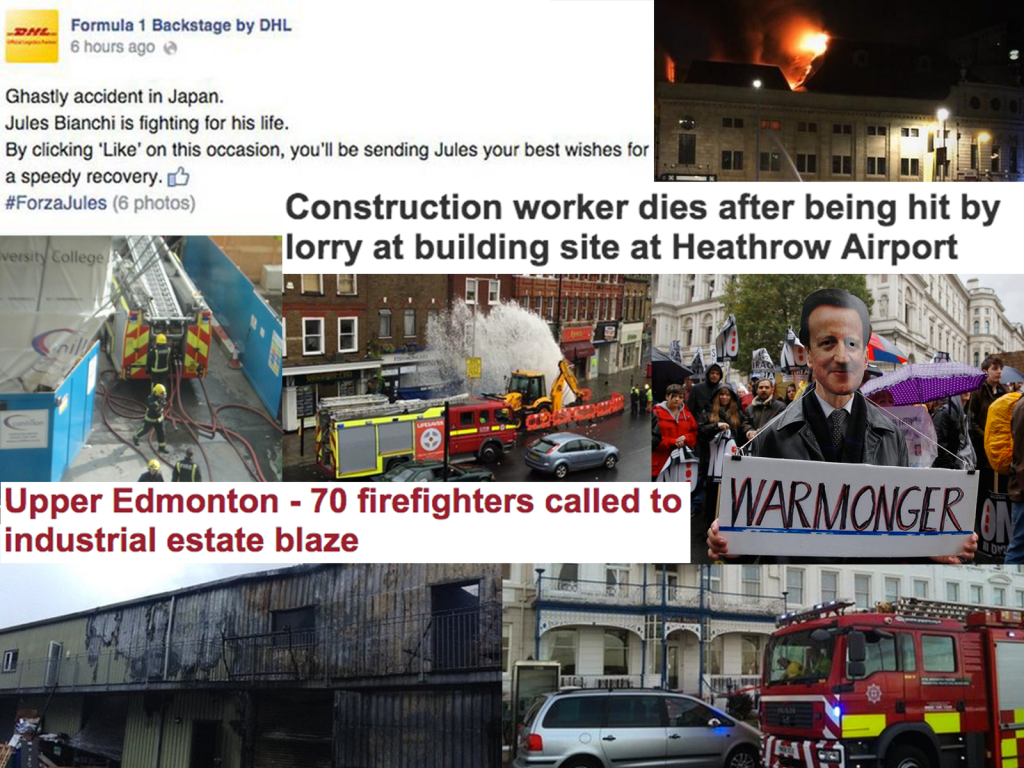

- It won’t happen to me – The same character traits that inspire us to become entrepreneurs (Tenacity, Passion, High Risk Threshold, Vision, Self Belief and Flexibility) are the very traits that reinforce the belief amongst business owners that ‘bad things happen to other people’ Putting statistics to one side for a moment, take a look at a montage of a few of the disasters that affected UK business owners during the first week of October 2014. We conservatively estimate the number of UK businesses affected by a Crisis each day to be in the order of 150+ (nobody captures the exact number as many/most incidents currently go unreported)

- I’ll deal with it myself if something happens – Again referencing the Entrepreneurial character traits of a business owner, we have the genuine belief that we can solve any Crisis situation that is thrown at us. We have solved numerous problems before, we can do it again. Given unlimited amounts of time, cash and customer tolerance to get things wrong and keep trying until we find a solution that works this is probably the case. However with 80% of SME businesses failing within 18 months of a Disaster (Source: AXA) there is definitely room for improvement. What if the business owner is the Crisis (ill health, death, breakdown etc)

- I’m Insured – Insurance is the ultimate fall back for business owners and with good reason as that is what it is there for. The question is whether the insurance you have bought actually addresses all of the risks your business faces. Have the risks been adequately identified? Is the Crisis event you are faced with an Insurable Loss? Will your insurance company give you the amount of help and assistance you need at time of Crisis? In most of our business owner conversations their current insurance provision was nowhere near as comprehensive as they thought it was, giving rise to a potential issue for the business and the insurance company when and if a claim is made.

So what do we know?

Our business funds our living costs and for many of us will become our pension. We know that the risks our business faces are increasing and at the same time the willingness of our customers to stick by us when we falter is reducing.

We know that our insurers cheque will help but they won’t spend the night on the phone helping to recover our business, so for most of us getting back to Business as Usual is down to us. We certainly know this is not something we have to do very often so it is not a core skill.

I would like to propose 3 simple steps for business owners to take now to become more resilient and improve their chances of Surviving and Thriving after a Crisis

1. Identify your Risks (make a quick list of the ingredients your business needs to trade, identify what events could interrupt those ingredients, find ways of reducing the risk (ie losing email = back up email regularly)

2. Review your Insurances (are you over or under insured, what would happen to the business and its employees if you died, are you covered for Business Interruption etc etc. – call your Insurance broker and discuss the details with them. If they don’t want to speak to you – change your broker!)

3. Know who to Call (when a Crisis occurs make sure you know who to call for help, save the telephone number(s) to your phone, and perhaps print a coupe of copies to leave at home and in the car just in case)